Should I Buy This Collectible?

This seems to be a question that comes up on a daily basis on https://www.reddit.com/r/mtgfinance/ . I’ve condensed hundreds of hours of Youtube videos and reddit browsing into a simple flowchart for you.

This is a continuation of my introductory article about collectibles investing: https://www.thepoxbox.com/posts/investing-in-collectibles-is-it-dumb

What is a vintage/investible MTG item?

It’s very difficult to predict exactly what thing will become a highly desirable collectible. Age and scarcity don’t matter if the demand isn’t there and fundamentally there’s no real reason why anyone would want a collectible other then as decoration. All we can do is make educated guesses based on past historical performances and our own assessment of the risks going forward.

What does “investible” mean?

To me it means a solid chance to compete with traditional index investing, going forward, factoring the risk/time/effort/research etc. that goes into collectibles. I’m basing my tiers mainly on price history. S-Tier items have returned sometimes in the 20-30% range, yearly, for 25+ years. The returns tended to be consistent and from the start. By comparison by the time you get to E-tier, you find items that may have had many years of 50%-100% growth but also long periods of flat growth. I still consider things in all these tiers to have some chance at competing with index investing or at least not dramatically falling behind.

But for the rest, even if the price of an item could only go up ( like a sealed box of Kaladesh or a Masterpiece or a Legends uncommon ) I don’t believe they have a particularly good shot at beating markets, so just buy something else if your goal is to make money.

MTG Investment Tiers:

I will go into further detail about these in subsequent articles, for now I will just give you a quick list of what goes into each tier.

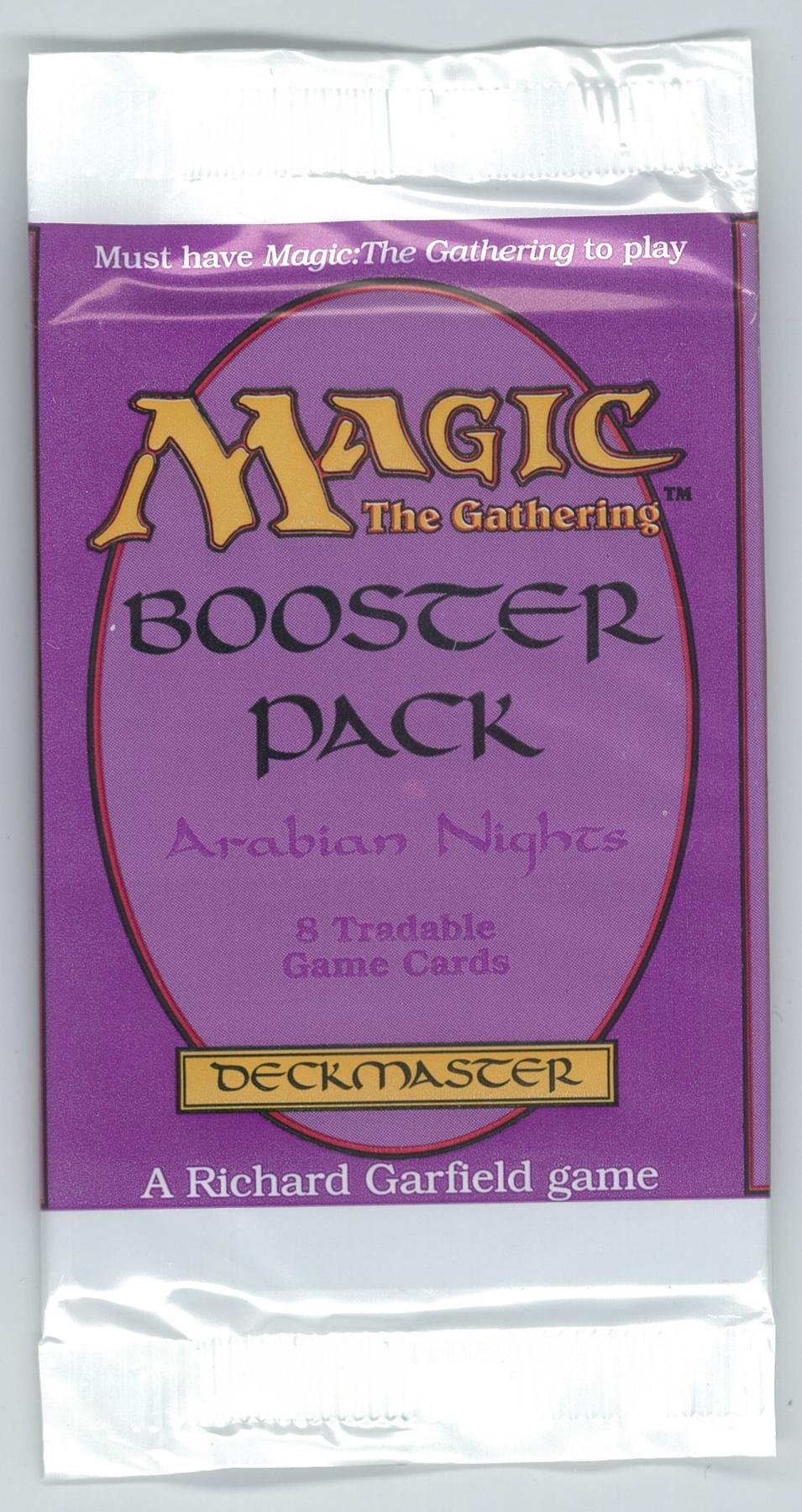

S-Tier: Sealed product of the 6 sets earliest sets: Alpha, Beta, Unlimited, Arabian Nights, Antiquities and Legends. Authentication and provenance are key if you want to get into this.

A-Tier: A/B/U Black Lotus. Not the CE/IA/30A version. This is the holy grail of magic and the single highest performing card over time.

B-Tier: Alpha rares/iconic ( bolt, shivan, birds), A/B/U Power 9.

C-Tier: Unlimited / Beta rares/playables, any Alpha, Sealed silver age ( The Dark, Revised, Alliances, Mirage Block, Tempest Block, Urza Block, 7th edition ).

D-Tier: Arabian Nights / Antiquities U1/U2/U3, Legends rares, lower end silver age sealed ( 1994-2012 range ), Old border foil playables/RL.

E-Tier: Old border foil rares, Arabian Nights C/U, Beta C/U/Lands.

Notable exclusions you might be wondering about:

Playable RL. Because of 30A I don’t believe it’s safe to keep holding onto currently expensive RL cards that derive most of their price from player demand. Dual lands being at the top of this list, but includes cards like Gaea’s Cradle, Mox Diamond, LED etc.

Jank Reserved list cards, especially crappy ones. The reserved list is no longer safe and the value of most of its cards depends a lot of player demand and speculation. The bad cards were never investible even with the RL secure, now none of these cards are ( unless they fit into the tiers mentioned above such as Alpha and Beta rares ).

Old but not investible: CE/IE, Unlimited C/U, Antiquities/Legends commons and cards from The Dark. These have all too many copies printed and/or too little true demand. CE/IE has become too much of a risk given WOTC’s recent behavior.

Not covered: Artist proofs, original art, signed / altered by artist, gold bordered cards, misprints, test prints, summer magic, unique promos, graded cards. I just don’t have any price history data on these. All I can say is many of these are very rare and/or unique and already extremely expensive.

Do you have passion for the game?

There’s really no point in exposing yourself to the risk and hassle of investing in collectibles if you have no emotional attachment to them. Then you’re turning what should be a hobby into a job, for pretty much little to no financial gain. Why?

Are you willing to hold onto this item for 5+ years?

Flipping collectibles over the short term is called “being a store” not investing. Markets are also unpredictable and selling expensive/unique items for a good price could take months or years. If you ever need your money back in a timely fashion, be prepared to take a huge financial hit.

Do you have a budget? A retirement plan? Savings? Etc.

Before you start parking money into cards ( or anything in life ), read this: http://earlyretirementextreme.com/

Then do the exercise of asking what you want to do/be in life and if your current spending/savings habits align with the future you want. Only once you’ve structured your finances properly can you begin to think about parking some of your money into high-risk goofy stuff like crypto, pogs and magic cards. While some items in MTG ( like an Alpha Black Lotus ) have stupidly massively destroyed traditional investing, you have to understand it was completely impossible to predict and it’s impossible to predict going forward.

At the end of the day collectibles are not income-generating assets like a stock or real estate.

Can you authenticate your collectible?

I way too often see people ask about whether or not their cards are fake. If you have to ask this question, you shouldn’t have bought them. Do you have the ability to make sure that if you’re going to spend 4-5 figures on an item, it’s genuine with good provenance?

Do you understand the fees/ tasks / risks that pertain to your buying and selling strategy?

There’s a myriad ways to buy and sell collectibles and they all have their own pros and cons. Buying an item from a store can cost you 30% more then buying it locally in person and you might get hit with another 20% in import fees or sales taxes. The same when you sell. Then there’s capital gains taxes. What are the tax implications of selling collectibles where you live? All of this can easily turn a 50% increase on paper into a net zero gain for you.

Do you have a plan to store and protect your cards?

Some people have no plans and didn’t consider the stress of having 5+ figures in easily stolen/destroyed collectibles sitting at home. Whether you go with a vault or with insurance, it might cost you a non-trivial amount of money to be stress-free.

What is your exit strategy?

Do you have an understanding of how you will sell your items and what the risks and costs of that are?

This is a topic for another day but many people seemingly accumulate collectibles without any clue on how to sell what they have and what they’re actually likely to get vs the “market value”.

In closing I really want to reiterate that you should not get into MTG “investing” if you have no love for the cards themselves. If you’re only vaguely familiar with them and have heard somewhere that collectibles or magic specifically is going to the moon, please reconsider getting into this until you at least develop some kind of deeper passion and understanding for these nerd toys.

About Me. Why would you listen to me?

I started playing in 1998 and sold my cards in the mid 2000s.

Retired at 35 and had all my finances in order before starting to buy back into MTG in 2016. Currently 37, have a 6 figure magic collection.

As far as I know, I am the only person who has tracked the price history of most vintage cards/sealed from 1994 to current. I will gladly share this data in further articles about this hobby!

I’ve watched hundreds of hours of finance/youtube videos and can confirm that they are 99% fluff and repetition, so just read my stuff and save yourself the hassle!